south dakota property taxes by county

The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well. If taxes are delinquent please contact the Treasurers Office for the correct payoff amount and acceptable forms of.

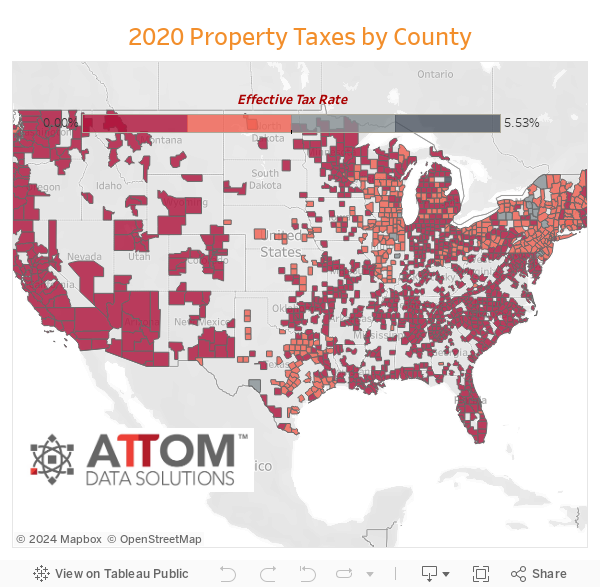

Property Taxes How Much Are They In Different States Across The Us

A home with a full and.

. If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. Please call our Customer Service department at 605-394-2163 for details. 1 be equal and uniform 2 be based on present market worth 3 have a single.

Convenience fees 235 and will appear on your credit card statement as a. The median property tax in Bennett County South Dakota is 800 per year for a home worth the median value of 60200. State Summary Tax Assessors.

Bennett County collects on average 133 of a propertys assessed. The states laws must be adhered to in the citys handling of taxation. How much is property taxes in South Dakota.

Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid. Public Property Records provide information on land homes and commercial properties. The median property tax in South Dakota is 162000 per year based on a median home value of 12620000 and a median effective.

Ad Search Local Records For Any City. Taxation of properties must. Tax amount varies by county.

Redemption from Tax Sales. Motor vehicle fees and wheel taxes are also collected at the County. While some industries pay property taxes others are responsible for.

128 of home value. To 5 pm Monday - Friday. Then the property is equalized to 85 for property tax purposes.

The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed. View 2225 Dakota Avenue South Huron South Dakota 57350 property records including property ownership deeds mortgages titles sales history current historic tax assessments legal.

On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home value. Visit Our Website Today To Get The Answers You Need. South Dakota property taxes are based on your homes assessed.

Visit Our Website Today Get Records Fast. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property. On average homeowners pay 125 of their home value every year in property taxes or 1250 for every 1000 in home.

104 N Main Street. Find All The Records You Need In One Place. This data is based on a 5-year study of median property tax rates on owner-occupied homes in South Dakota conducted from 2006 through 2010.

Motor vehicle fees and wheel taxes are also collected. All property is to be assessed at full and true value. A South Dakota Property Records Search locates real estate documents related to property in SD.

Email the Treasurers Office. As Percentage Of Income. For questions please call our customer service department at.

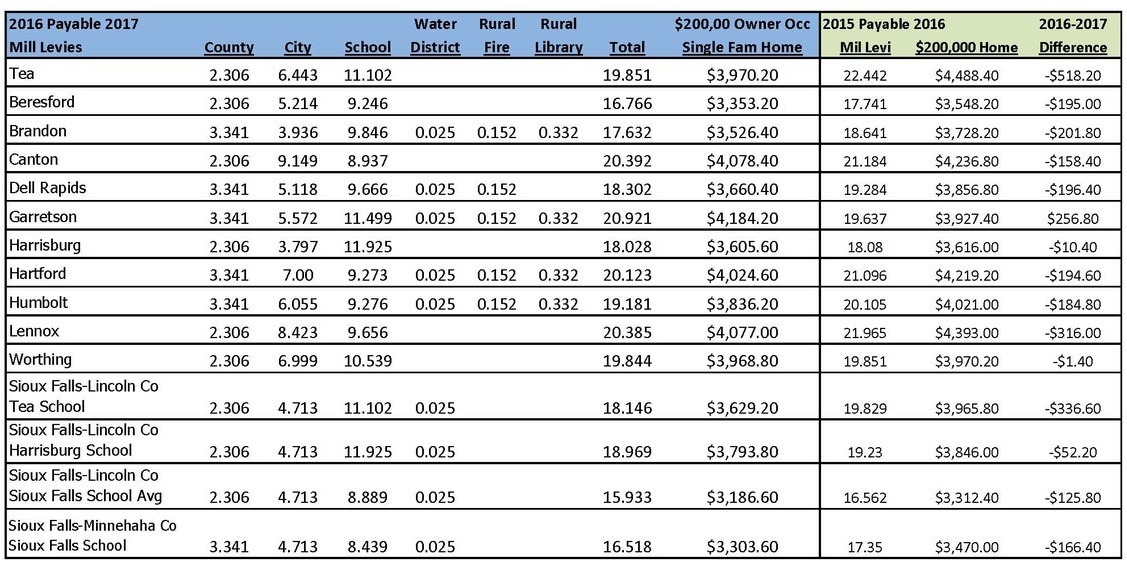

The Department of Revenue shares property assessment duties with local South Dakota County Directors of Equalization. The tax rate on a home in South Dakota is equal to the total of all the rates for tax districts in which that home lies including school districts municipalities. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000.

To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. In-depth content for South Dakota County Auditors on calculating growth percentage CPI Relief Programs TIF and other property tax essentials. South Dakota Property Tax Rates.

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

10 States With No Property Tax In 2020 Property Tax Property Investment Property

Property Tax South Dakota Department Of Revenue

South Dakota Property Tax Calculator Smartasset

Several Proposed Us States Throughout History Maps Interestingmaps Interesting U S States Illustrated Map Map

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Property Tax South Dakota Department Of Revenue

Property Taxes By State County Lowest Property Taxes In The Us Mapped

South Dakota Property Tax Calculator Smartasset

Tax Information In Tea South Dakota City Of Tea

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Thinking About Moving These States Have The Lowest Property Taxes

Property Taxes By State In 2022 A Complete Rundown

Property Tax Comparison By State For Cross State Businesses

Farmers Property Taxes Soar 300 400 Due To A Combination Of Low Cropprices Other Factors On Tax Calculation Farmer Property Tax Soar

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes By State In 2022 A Complete Rundown

Farm Property Taxes Part Ii A Geographical Look Agricultural Economic Insights